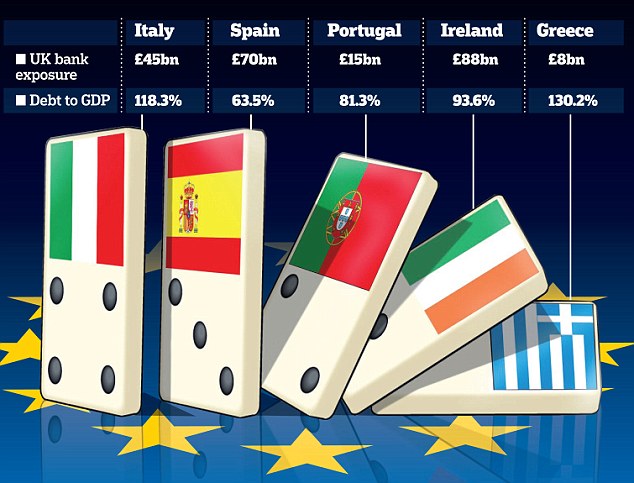

The political response to the ongoing euro crisis for years is with the same solution: to override the principles of responsibility and liability. With the European Stability Mechanism, not only the transfer union is getting closer, but it also has more implications that are serious. Call it Euro-drama, state over indebtedness or banking crisis. What the supposedly different concepts have in common.

For several years,  the political answer always is the same: responsibility and liability of the actors have been systematically repealed. As this disclaimer and this irresponsibility practiced concretely, is currently observed in Greece: EFSF, the Greek Government in April paid 25 billion euros to stabilize the Greek banking sector. This week, the majority of them, namely 18 billion euros, issued to recapitalize the four largest banks in the country (Alpha, EFG, NBG and Piraeus).

the political answer always is the same: responsibility and liability of the actors have been systematically repealed. As this disclaimer and this irresponsibility practiced concretely, is currently observed in Greece: EFSF, the Greek Government in April paid 25 billion euros to stabilize the Greek banking sector. This week, the majority of them, namely 18 billion euros, issued to recapitalize the four largest banks in the country (Alpha, EFG, NBG and Piraeus).

The capital increase was implemented in addition to the non-voting preferred shares. Thus, the existing shareholders retain undiminished influence, while the EFSF may affect, as giant investors did not continue the business practices of these banks. “No bail-out” yesterday, in the Treaty on the Functioning of the European Union agreed to in Article 125 Not liable for the debts of other Member States.

Now is introduced into the domestic politics of the mock combat rejection of euro bonds, with which a common European borrowing is meant. They would mainly at the expense of previously good credit and Germany and the interest burdens for the German national debt by 50 billion euros per year. Actually, the European Stability Mechanism (ESM) will permanently transform the euro zone into a transfer union.

For the ESM can hold its own bonds to finance the over-indebted countries and their banks at the expense of more solid member states. And the ESM will abolish the national sovereignty of the German legislature because its committees – the so-called Board of Governors, in which the finance ministers of the Member States have a seat and voice, acting by a majority, if new money is used to rescue crisis.

Government and parliament are no longer in demand. It is a political scandal of the first order. This question is ultimately so central that it would be good to hold a referendum on it.